According to market news, Jiangsu Eurasia Film Co., Ltd. will be acquired by Zhengzhong Investment Group with a proposed capital of 410 million yuan and handed over to Suzhou Molik New Materials Co., Ltd. for management. The signing ceremony is scheduled to be held on April 18, 2017.

At the end of June 2014, Eurasia Group became insolvent and its BOPET production equipment in Zhejiang and Jiangsu were seized. At the end of 2015, Rongsheng Petrochemical acquired Zhejiang Eurasia Thin Film Materials Co., Ltd. and changed its name to Yongsheng Thin Film Co., Ltd. on January 13, 2016. Zhejiang Eurasia resumed production on May 16, 2016, and its products are selling normally.

Now, a year later, Jiangsu Eurasia Films will also have a “new owner”. After 8 months of trusteeship in the Far East, Rongsheng Petrochemical acquired the Zhejiang subsidiary… After many years of twists and turns, Eurasia Films went bankrupt. This journey is not easy, and the polyester film industry will face another major test.

After two bankruptcies, Eurasia Group’s bankruptcy acquisition was extremely difficult!

In May 2014, news that Cifu Group’s liabilities exceeded 5 billion yuan and some of its loans were overdue attracted widespread attention in the industry. Until the end of June 2014, Eurasia Group, as a subsidiary of Cifu Group, was insolvent and its BOPET production equipment in Zhejiang and Jiangsu were seized. During this period, the government took the lead in negotiating mergers and acquisitions with Far East Petrochemical. After the agreement was reached, Far East Petrochemical led the start-up of its four production lines in Zhejiang by mid-July 2014. However, Far East Petrochemical was only in custody for eight months. On March 22, 2015, PTA giant Far East Petrochemical initiated bankruptcy proceedings. Eurasia Films once again entered bankruptcy proceedings.

It is understood that the polyester film project of Zhejiang Eurasia Film Materials Co., Ltd. invested a total of 1.7 billion yuan and was fully put into production in 2005. At its peak, the company’s polyester film monomer production capacity accounted for approximately 1/3 of the total domestic production capacity. The melt direct film drawing process is even more advanced in the world, surpassing DuPont of the United States and Mitsubishi of Japan at that time. In 2008 alone, the company had total assets of 2.8 billion yuan, achieved sales revenue of 2.13 billion yuan, and profit of 98.64 million yuan.

At the end of 2015, Yizhe Rongsheng Petrochemical acquired Zhejiang Eurasia Film Materials Co., Ltd. and a 300,000-ton chemical fiber factory owned by Cifu Group, including land use rights, buildings and structures, equipment, emission rights, trademark inventory and other movable, real estate and property News about sexual rights has once again attracted widespread attention in the industry.

The fate of Jiangsu Eurasia Film Co., Ltd. seems to be even more bumpy. According to data, Jiangsu Eurasia Film Co., Ltd. was established in April 2009 and was jointly invested by Zhejiang Cifu Group and Shuyang County State-owned Assets Investment and Management Co., Ltd. At that time, the company introduced a set of internationally leading polyester equipment and 5 advanced German Dornier film drawing production lines. It adopted the direct melting process with a width of 8.3 meters and a production capacity of 30,000 tons. It can produce films with a thickness of 8μ- 75μ, the company has an annual production capacity of 280,000 tons of polyester and 150,000 tons of BOPET film. In mid-July 2014, Far East Petrochemical took over its four production lines in Zhejiang Eurasia. Jiangsu Eurasia has been in a state of waiting for acquisition for the past three years. Now, after many years, Jiangsu Eurasia Film will also usher in a “new owner”, and the polyester film industry will face another major test.

Today, when there is a serious surplus of general film, what will the return of Jiangsu Eurasia bring?

The BOPET industry in 2009-2010 can be described as a golden industry. Due to small production capacity and large market demand, the market once reached a state of supply exceeding demand, and the profit of one ton of BOPET film reached tens of thousands of yuan. But the good times did not last long. With the gradual release of production capacity, the BOPET market changed from undersupply to oversupply. Profits also increased from more than 10,000 yuan back then to a loss of about 1,000 yuan per ton now. In just 5 years, BOPET fell from heaven to hell.

From 2010 to 2015, the BOPET industry production capacity increased dramatically. The total BOPET production capacity was 706,900 tons in 2009, and increased to 2,705,500 tons in 2015, an increase of 1,998,600 tons, an increase of 282.7%. Among them, ordinary films are the main ones, accounting for about 80% of the total production capacity. Especially in 2010 and 2011, the production capacity growth rate reached 27.27% and 34.66% respectively. The industry’s production capacity was once saturated, but this is not over yet. In 2014, Jiangyin Xingye and Yingkou Kanghui Petrochemical were put into production one after another, both of which were direct melting integrated equipment and raw materials. It is PTA, and the cost is 500-1,000 yuan/ton lower than that of drying equipment using PET as raw material, further strengthening the vicious competition in market prices.

In the two years since 2014, China has fallen into an embarrassing situation where the supply of general-purpose polyester film products exceeds demand, while the supply of special-purpose polyester film products exceeds demand, so they can only import from foreign manufacturers. This is an obvious structural excess. The competition in the low-end market is becoming increasingly fierce, and companies have to maintain market share by lowering the price of BOPET, resulting in a continuous decline in gross profit margins. Many companies have failed midway. The remaining companies are trudging through the quagmire, constantly exploring ways out, hoping to be able to do so as soon as possible. Get out of trouble.

It can be said that “Success is a failure, failure is a failure”. Yesterday’s BOPET market sounded the alarm for most companies. Now it is different from the past. With the strong return of the leading polyester film, can the BOPET market regain its former glory? To what extent the resumption of work in Europe and Asia will affect the market, how to develop in the later period, and how to gain a firm foothold in the wave of the times, may be questions that business owners should think about. Let us wait patiently!

Link: Genzhong Investment Group Co., Ltd. and Suzhou Molik New Materials Co., Ltd.�Introduction to Ltd.

Genzon Investment Group (“Genzon Group” for short) was established in December 2003. After more than ten years of steady operation and efficient development, it has gradually grown into a company with real estate and medicine as its main businesses, integrating new materials, metal plates, cold chain, and funds. It is an industrial and financial group integrating multiple business sectors such as , venture capital, golf, hotel and catering, etc. The group is headquartered in Shenzhen, China, with more than 4,000 employees.

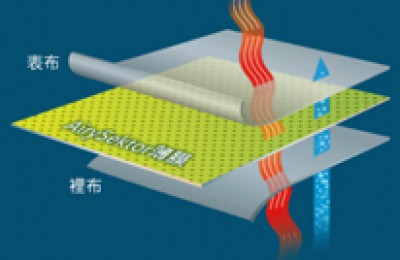

Suzhou Molecon Novel Materials Co., Ltd. is a comprehensive enterprise established in China solely by Molecon Novel Materials, Inc. of the United States, integrating the R&D, production and sales of degradable and recycled polyester raw materials and agricultural film products. The company is located in Suzhou Industrial Park, which has a developed economy and beautiful environment, with a registered capital of US$10.4 million and a total investment of US$25 million. The company has strong R&D strength, and its R&D team consists of 3 PhDs, 2 postdoctoral fellows and 10 masters. The company’s degradable polyester synthesis technology is the first in the world and it has independent intellectual property rights and patented technology. At present, the company’s “Sky Light” shed film product has reached the world’s leading level in terms of light transmittance and thermal insulation.

</p