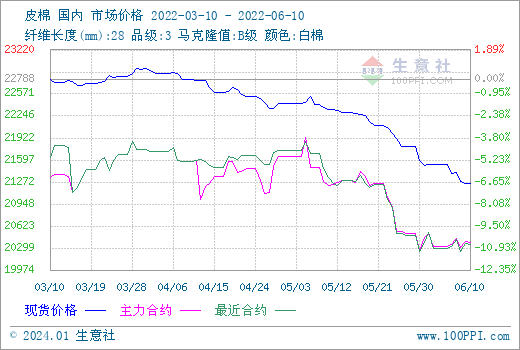

According to data from SunSirs, the price of 3128B lint cotton was around 21,251 yuan/ton on the 10th, down 1.27% from the beginning of the month and down 4.88% month-on-month.

2. Market Analysis

The focus of the cotton market this week is downward. On the 10th, the domestic cotton price index 3128B level average price was 21,247 yuan/ton, down 133 yuan/ton from last weekend. After the Dragon Boat Festival, the cotton spot market is still in a weak position. Textile enterprises are not very enthusiastic about purchasing. They maintain the strategy of purchasing raw materials at low prices. The support for prices is limited, and the sales progress of lint cotton is slow. As of June 2, the national lint sales rate was 56.6%, a year-on-year decrease of 41 percentage points, far behind the same period in previous years, and commercial inventories were at a historical high for the same period. According to statistics from Mysteel agricultural products, as of June 3, the amount of commercial cotton in stock was 3.5275 million tons, a month-on-month decrease of 3.3%, an increase of 18.86% over the same period in 2021, and an increase of 10.67% over the same period in 2020. According to the latest news from the Ministry of Agriculture and Rural Affairs, cotton imports will be reduced by 100,000 tons this month to 2 million tons, taking into account factors such as the large scale of new cotton for sale, the obvious price difference between strong cotton prices outside and weak domestic prices, and weak downstream demand for cotton.

In terms of futures, the settlement price of Zheng Cotton’s main 2209 contract on the 10th was 20,380 yuan/ton, an increase of 35 yuan/ton from the beginning of the week. This week, due to the surge in PTA and short fiber spot futures prices, short fiber even hit a new high since its listing. The surge in chemical fiber prices has slowed down the substitution effect of short fiber on cotton in the short term, and Zheng cotton futures have recovered slightly. However, due to the weak downstream pattern, it is difficult for Zheng Cotton to have a big rise at present.

Internationally, international cotton prices are firm. On June 8, the Indian government approved an increase in the MSP purchase price for 2022/23. The medium length was raised to 6,080 rupees/quintal, a year-on-year increase of 6.2%; the longer length was raised to 6,380 rupees/quintal. burden, up 5.9%. Effective from October 1st. On June 9, the price difference between domestic Xinjiang cotton and U.S. cotton was -3,792 yuan/ton, a record low, and the price advantage of domestic cotton became even more obvious. Last week, U.S. cotton signings remained strong and China’s increased purchases pushed cotton prices up sharply. The July ICE cotton futures contract soared nearly 6 cents. As of the 9th, the settlement price of the July contract was 146.51 cents, an increase of 8.77 cents from Monday; December The contract was 124.93 cents, up 5.13 cents from Monday. On the 9th, the main force of ICE cotton futures moved positions to the 12 contract. On the 9th, the international cotton price index (SM) was 159.33 cents/pound; the international cotton price index (M) was 157.56 cents/pound.

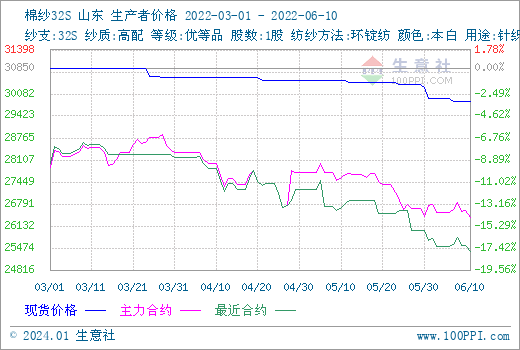

3. Downstream industrial chain

Business News data shows that on the 10th, the price of 32S cotton yarn in Shandong was 29,866 yuan/ton, down 2.08% from the previous month. The current downstream demand is sluggish, the upstream cotton market is declining, and the price of cotton yarn products is weak. On the 30th, FCY Index C32S (imported cotton yarn price index) quoted 33,329 yuan/ton (0); cotton yarn prices in some areas: OEC21S produced in Shandong arrived with invoices at about 19,600 yuan/ton, and high-end C32S knitting yarn produced in Henan arrived with invoices. The price is around 28,800 yuan/ton, and the high-quality compact spinning C40S produced in Hubei arrived with a ticket at 30,800 yuan/ton. In terms of futures, cotton yarn futures fell this week for 10 days. The settlement price of the main 2209 contract of cotton yarn was 26,385 yuan/ton, a decrease of 385 yuan/ton from the beginning of the week.

This week, the off-season atmosphere of the cotton yarn spot market is getting stronger. The price difference between domestic and foreign prices has been significantly inverted. Spinning profits have been restored. Market transactions are not as good as in May. Textile companies have slowed down their delivery speed, and inventories have begun to rise again. Due to the current scarcity of new orders, many textile companies are confused about the market outlook. If the market continues to be flat in July and August, some textile companies still have plans to reduce the number of starts. Cotton prices in India’s domestic market are much higher than international prices, so production costs for Indian cotton mills remain high. Because imported cotton yarn is nearly 30 rupees/kg cheaper than local yarn, India imported cotton yarn for the first time this year to ensure domestic supply.

According to the General Administration of Customs, my country’s textile and clothing exports in May were US$29.227 billion, a year-on-year increase of 20.36% and a month-on-month increase of 23.89%. Among them, textiles were US$14.028 billion, a year-on-year increase of 15.76% and a month-on-month increase of 14.43%; clothing was US$15.199 billion, an increase of 24.93% and 34.12% respectively.

Forecast for the market outlook: Cotton yarn stocks are high, and chemical fiber prices have increased significantly recently, which has narrowed the price difference between cotton and viscose, but has a moderate effect on boosting cotton prices. The market for gray fabrics continues to be sluggish, and weaving mills lack confidence in June orders. There is no positive improvement on the textile demand side. It is expected that the short-term cotton yarn market will remain weak. Pay attention to the situation of downstream orders. </p