Recently, Brent crude oil has risen strongly to US$71/barrel, while PTA, which is priced at cost, has performed weakly. This is mainly because PX, the direct raw material of PTA, is facing the dilemma of expanding inventory. The price difference between PX and NAP has been continuously compressed recently, and the increase in crude oil has not been reflected in the PX end at the same rate. Due to the profit concession in the PX link, PTA processing fees have recently risen to high levels. PTA factories have the motivation to lock in processing fees, and given the high valuation, they are not very attractive to new long orders, and the market performance is weak. Looking forward to the market outlook, we believe that the short-term terminal is still in the off-season, the pressure on the supply side is relatively high, processing fees are expected to return to low levels, and PTA pricing power is still on the cost side. If crude oil prices continue to rise recently, PTA may digest high valuations in a volatile manner; if crude oil prices fall in the short term, PTA may be weaker than crude oil and accelerate its decline. At present, we are still optimistic about crude oil. Under the forecast of rising oil prices, PTA is expected to digest its high valuation in the form of shocks. From a unilateral perspective, there is no trend opportunity. It is expected that PTA will fluctuate widely between 4550-4950, following crude oil, correcting to the lower edge of the range, and participating in multiple single waves. Recommend option selling wide straddle strategy to make profits. Get the premium income, for example, sell TA109P4400 and sell TA109C5000 at the same time.

1. Cost: PX faces the risk of inventory expansion and the rise in oil prices has not been transmitted to the same extent

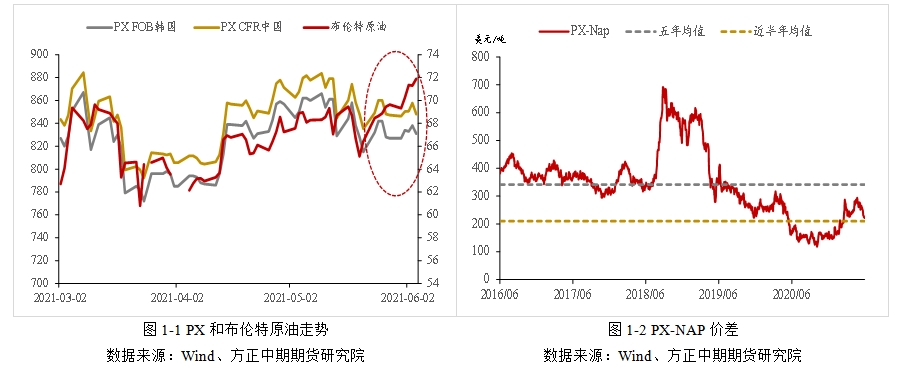

Oil Price The increase failed to be transmitted to the PX end at the same rate. Recently, the international oil price has stood strongly above 71 US dollars per barrel. However, for PX, the direct raw material of PTA, due to the recent continuous compression of the PX-NAP price difference, the increase in oil prices has not been simultaneously transmitted to the PX end. Specifically, from May 20 to June 4, Brent crude oil rose by $71/barrel from $65/barrel, an increase of 9.23%; PX cfr China rose from $845/ton to $848/ton, an increase of 3.55 %.

PX inventory continues to accumulate, facing the risk of inventory expansion, and the PX-NAP price difference has been significantly compressed. According to Zhuochuang data, as of the end of April, PX social inventory was 2.7909 million tons, rising for two consecutive months since February. The liquidity in the spot market has been loose recently, and PX inventory is close to the high in October 2020. As a liquid chemical product, it is facing pressure from tank expansion. Referring to the inventory high in October 2020, the PX-NAP price difference has been compressed to below US$150/ton. The current PX-NAP price difference is US$212/ton, and the PX-NAP price difference is expected to remain weak. The recent weak spread of PX-NAP is mainly due to the following reasons: First, import volume remains high. Second, PX production efficiency improved significantly from January to April, and the production efficiency of pure benzene was high. Some factories postponed their maintenance plans in May. As a result, some downstream factories have prepared stocks in advance in response to supplier maintenance, and the PX device maintenance has been postponed, resulting in an increase in supply in the spot market. Third, the time difference between the commissioning of a large-scale PX and PTA device is expected to narrow. In the second quarter, the original domestic PTA unit of 3.5 million tons/year and the PX unit of 2.5 million tons/year were scheduled to be put into operation. According to the original plan, the PTA unit would be put into operation one month earlier than the PX unit, which led to companies purchasing in advance in the market. PX. However, due to the delay in the commissioning of the PTA device, the PX purchased in advance was sold externally, and the supply of PX in the spot market further increased. In the short term, due to the tank expansion problem, the PX-NAP price difference has remained weak in the near future. Follow-up attention will be paid to the time difference between the commissioning of a large-scale PX and PTA device.

2. Supply: The processing fee is high and the maintenance performance is not as good as expected

The processing fee is too high and the PTA maintenance performance is not as good as expected. As the profits of the PX link have been significantly compressed recently, at the end of May due to the expected equipment maintenance, the reduction of supply by mainstream suppliers, and the unexpected shutdown of Yisheng equipment, PTA spot processing fees increased significantly compared with the previous period. Last week, the PTA spot processing fee (excluding acetic acid) once rose to around 700 yuan/ton. A sharp rise in processing fees will have the following two impacts: first, the PTA factory will charge processing fees to sell guaranteed locks; second, the PTA device maintenance plan will be postponed. Except for the 750,000 tons/year PTA unit of Yadong Petrochemical, which was shut down for maintenance for 10 days on June 6, maintenance plans for multiple PTA units in June were changed to pending, and supply-side losses were less than expected. Considering that around mid-June, Yangzi Petrochemical, Yisheng Ningbo and other units have plans to restart and increase load. If there is no subsequent follow-up of equipment maintenance, the PTA operating rate will increase from the current 80% to over 85%, and the pressure on the supply side will rebound. .

3. Demand: Polyester production efficiency is poor and operating rate is low

Poor terminal orders , polyester inventory pressure is high, production efficiency is poor, and the operating rate fluctuates and weakens. May to July is the traditional off-season for the terminal textile and weaving industry. Currently, the inventory of gray fabrics in Shengze area is 40-41 days, and the overall inventory level is relatively high; the inventory level of the main weaving bases in Jiangsu and Zhejiang is 29.4 days, and corporate funds and warehousing are facing greater pressure. , some companies were forced to reduce their operating rates, and the operating rate of looms in Jiangsu and Zhejiang dropped to 81%. The potential risk point in the future lies in the impact of high-temperature power-limiting measures in summer on the operating rate of looms.Sound. Polyester factories are currently regulating inventory pressure through periodic promotions. However, due to the continuous decline in the stocking level of raw material polyester for weaving, the promotional effects of polyester factories have gradually declined, and the production efficiency of polyester products has also continued to be compressed. As of June 4, the polyester operating rate was 90.8%. With the follow-up maintenance of some short fiber equipment, the polyester operating rate may drop to around 90%. At present, as the base of polyester production capacity is also rising, the narrow decline in polyester operating rate will have limited impact on rigid demand, but we need to be alert to the risk of a sharp decline in polyester operating rate in the future.

Four. Inventory: The extent of destocking requires significant attention to the follow-up of PTA maintenance

Maintenance drive Library, pay attention to the follow-up efforts of subsequent device maintenance. According to Zhongpu data, as of June 4, PTA social inventory was 2.62 million tons, 1.26 million tons destocked from the high of 3.88 million tons at the end of February. Since March, the PTA industry has been affected by low processing fees and intensive maintenance of equipment. In addition, the production time of Yisheng’s new material equipment has been delayed. Due to the urgent need for downstream follow-up, PTA social inventory has dropped significantly. In June, the market originally expected that the industry would continue to destock due to the follow-up maintenance of multiple sets of equipment. However, due to the current high PTA processing fees, there is uncertainty about whether multiple sets of equipment can be overhauled. If they are not overhauled, the industry will return to accumulated inventory in June, and the starting point of accumulated inventory may be mid-June.

5. Summary and operational suggestions

PTA Option Strategy: Wide Straddle

In the short term, PTA processing fees are high and valuations are at a high level, which leads to cautious entry of long orders, and manufacturing companies also sell guaranteed lock processing fees motivation. In the medium term, international oil prices are currently driven by expectations of demand recovery, and the center of gravity is still fluctuating upward. There is cost support below PTA, but due to the compression of PX-NAP and PTA’s own processing fees, the overall performance of PTA will be weaker than crude oil. It is expected that the PTA09 contract will digest the high valuation in the form of shocks in the near future. The overall operating range is 4550-4950. There is no trend market for the time being, and unilateral band participation is mainly involved. In terms of option operations, a wide straddle putting strategy is recommended, such as selling TA109P4400 and selling TA109C5000 at the same time. </p